Fundface Political Epistemology

Defining a Life Free From Poverty in the Caribbean

Author: Fernan Moore | Publisher: www.fundface.org | Date: December 2021

What value of income would allow one a decent quality of life in Trinidad and Tobago and by extension the Caribbean?

Fundface’s ‘political epistemology’ is a logic and knowledge-based framework which aims to systematically define what US dollar income amounts would guarantee the average working adult in Trinidad and Tobago and by extension the Caribbean, a decent quality of life or a life without poverty.

It was developed to complement Fundface's proprietary investment framework, which aims to systematically shift the life quality paradigm for the better, for many in the Caribbean region.

It was inspired by the author's (Mr. Fernan Moore’s) desire to improve life quality, after gaining an ethnographic insight, on the debilitating life quality experienced by minimum wage earners in Trinidad and Tobago. Mr. Moore’s ethnographic perception (personal truth) on the poor life quality experienced by minimum wage earners in Trinidad and Tobago, prompted them to ask a series of epistemological questions around the concept of life quality; like: “What is a decent life quality?” and “How can the average working person in Trinidad and Tobago earn one whilst earning minimum wage?”. The goal of this article is to present Fundface's political epistemology regarding what US dollar income amounts would guarantee the average working person in Trinidad and Tobago and throughout the Caribbean, a decent quality of life or life without poverty.

The main focus of this article will be to answer the following questions:

- What is a Political Epistemology?

- What US dollar value of income would allow one a decent quality of life in Trinidad and Tobago and by extension the Caribbean?

- What is causing the mass poverty within Trinidad and Tobago?

- What are the effects of devaluation?

- What is Fundface's solution?

- What are the benefits to all parties involved in Fundface's solution?

What is a Political Epistemology?

In life, there are primarily three categories of truth that govern the way we interact with our world and reality, these three truths are taxonomically classified as: ‘personal truth’, ‘political truth’ and ‘objective truth’. Personal truth refers to our experiences in life, it is responsible for our subjective worldview and who we are as individuals, it is what defines us— political truth on the other hand however, is centered on official policy, it is the rules and laws which govern the society and earth we live on— and lastly, objective truth, is truth, regardless of if we choose to believe it or not, it is undebatable. Political Epistemology is centered around objective and political truth. It lies at the intersection of political philosophy and epistemology. Where ‘epistemology’ is the theory of knowledge applied to what we know — ‘political epistemology’ — is the theory of knowledge applied to politically relevant aspects of our lives.

To put simply, political epistemologists investigate the ways in which epistemological issues are at the center of our political lives. They explore how claims of knowledge, truth, and expertise impact political decisions and forms of legitimate authority. For example, assuming one of the goals of politics should be to bring about just societies and a just world, one question political epistemologists will try to answer is the question of how to acquire knowledge of what is just.

As a financial advisory founded by a political scientist, we at Fundface concern ourselves with politics and its prime goal of bringing about just societies and a just world. We believe a just society to be a society wherein all working members are adequately remunerated for their hard work. Adequate remuneration for us, means, a decent quality of life or a life without poverty.

Unfortunately (as seen through the ethnographic perception of the author); minimum wage earners in Trinidad and Tobago live an indecent quality of life due to insufficient earnings. The poor remuneration of minimum wage earners in Trinidad and Tobago inspired us to investigate the quantitative measures used by the Trinidad and Tobago government to assess human wellbeing in the twin-island. Upon investigating we learned that there are no quantitative measures put in place by the Trinidad and Tobago government to assess life quality or human well-being within the twin-island.

The absence of an official quantitative framework for assessing human well-being in Trinidad and Tobago by the Trinidad and Tobago government suggests that there is no political will or a lack of competence by the government and government officials for improving life quality in the country.

In recognition of this, we at Fundface launched an epistemological inquiry into: “what US dollar value of income would guarantee one a decent quality of life or a life without poverty in Trinidad and Tobago and by extension the Caribbean?” and thus was able to derive our political epistemology.

What US dollar value of income would guarantee one a decent quality of life or a life without poverty in Trinidad and Tobago and throughout the Caribbean?

Epistemological research is centered around the truth, meaning, it is truth-seeking— it asks epistemological questions that would help deduce the truth, like: "how do we know what we know?" and from these epistemological questions, we learn the truth—which then becomes knowledge. Therefore when we pursue epistemological truth on : " what US dollar value of income would guarantee one a decent quality of life or a life without poverty in Trinidad and Tobago and throughout the Caribbean?"; we need to ask the relevant questions that would give us the truth. We need to ask questions like "what is a decent quality of life?" and " what is not?".

Fortunately at Fundface, we know the truth as to what is not a decent quality of life, and that is a life of poverty. We know people living in poverty are not subjected to a decent quality of life, primarily because one's life quality in global civil society is largely determined by the amount of income one is able to earn. The more income one is able to earn the better the chances of one enjoying a decent quality of life, unfortunately, because of insufficient earnings people living in poverty live an indecent quality of life. Therefore, by deductive reasoning, it can be asserted that since a life of poverty is responsible for an indecent quality of life; a life without poverty should be considered a decent quality of life. Knowing this truth opens up the discussion as to the details as to what poverty truly is. By objectively defining or knowing the true definition of poverty, we are able to truly understand the income amount that will allow one a life free of poverty. To do this we must first numerically define poverty.

In most developed countries (if not all) poverty is measured or numerically defined using a quantitative metric called a poverty line. The poverty line is a scientifically-derived, calculated income amount, that is used to numerically determine if one is living in poverty or not. If one is earning an income below said poverty line, then one is considered to be living in poverty and therefore classified as poor, and in need of government intervention.

The poverty line represents a numerical and therefore objective format for interpreting poverty thereby allowing for the realization of objective truth on the subject matter. However, there have been many different interpretations of the poverty line by social scientists, governments and non-governmental organizations throughout the World System, which in turn has served to subjectify and therefore abstractify the very concept of poverty itself, leading one to believe that there is no true numerical definition of poverty. For example: the United Nations has a poverty line, but so does Canada and the United Kingdom; these various interpretations of what poverty is, implies that the concept of poverty is a very subjective and therefore a political matter.

Nevertheless there is political and numerical truth as to what poverty is, this truth can only be found in the United States Poverty Guidelines.

What makes the United States’ poverty guidelines the true or universal definition of poverty in the world system, has a lot to do with the fact that it incorporates the use of ‘the world reference currency’ (the United States dollar) as a quantitative unit of measurement, in determining the income amounts that would constitute poverty( the United States poverty lines).

The United States' dollar relevance to the true universal definition of poverty can be backdated to the political arrangements made in the Bretton Woods Policy, which systematically established the United States dollar as the world reference and hegemon currency of the World Economic System.

For context reasons; the Bretton Woods Policy or the Bretton Woods Agreement is a collaborative post World War 2 financial policy signed at the United Nations Conference at the Bretton Woods New Hampshire hotel in July 1944; by the previously warring states of that era. The Bretton Woods policy was created in order to establish a regulatory international financial system by which the United States dollar would replace gold as the international currency standard in global trade. This policy was successful in establishing the United States Dollar to become the most widely used and dominant currency of the World System to date,—a truth which is further backed by a letter published by Federal Reserve Board economist Ruth Judson, wherein it is stated that more than 60%(sixty percent) of all U.S bills and nearly 80%(eighty percent) of all US $100 bills (United States one hundred dollar bills) are currently circulating overseas or outside of the United States; being used as a reserve currency for over 60% of all central banks in the World System (this includes the central bank of Trinidad and Tobago )— furthermore more than 50% (fifty percent) of all debt issued Internationally are denominated in United States dollars, hence the United States dollar is the most widely used currency to date. That is to say ; over 60% (sixty per cent) of all countries within the World System depend on and use the US dollar as an instrument of financial stability, trade, savings and investments, hence it being the world currency.

The political merit of the United State's dollar being the world reference and fundamental unit of value for trade savings and investment in the modern global trade system; lends itself to the definition of poverty said US dollar is used in i.e. the United State's Poverty Guidelines, thereby tacitly crediting the United States Poverty Guidelines as the world reference definition of poverty due to its intertwined nature with the world reference currency—the United States dollar. Or simply put; the Bretton Woods policy functions as the political truth responsible for making the United States policy on poverty the politically true and world reference framework for identifying poverty. Therefore, since the United States, Poverty Guidelines are the "world reference " guidelines on poverty, these poverty guidelines can therefore be applied to non-United States territories especially those countries where there are no official measures for poverty or human wellbeing by the government, — for instance, places like Trinidad and Tobago and the rest of the Caribbean.

In fact, the lack of assessment guidelines for human wellbeing by the authorities of the Caribbean region is the main reason why Fundface is pursuing epistemological truth on "what US dollar income value would guarantee one a decent quality of life or a life without poverty " because currently there are no life quality assessment frameworks produced by the Trinidad and Tobago government to assess human wellbeing in the twin-island we are a part of. This is the same in other Anglo Caribbean islands as well. This is why we made it our responsibility to secure the wellbeing of all in the republic; because we find the absence of an indigenous life quality assessment framework by the Trinidad and Tobago government to be very concerning. It suggests that there is no political will among public officials to improve life quality within the twin-island state. The lack of political will for improving life quality is evident by falsehoods told by government officials who use statistical economic data to lie about the state of affairs within the country.

Statistical measures such as income per capita, GDP per capita and the LQI (Life Quality Index) are some examples of economic measures used by the government to lie about life quality and income within a given country.

These lies can be objectively proven to be lies when we analyze stuff like "the life quality index "for example. The Life Quality Index or LQI is a calibrated compound social indicator of human welfare that reflects the expected length of life in good health and enhancement of the quality of life through access to income. The Life Quality Index combines two primary social indicators: the expectancy of healthy life at birth, E, and the real gross domestic product per person (per capita income), G, corrected for purchasing power parity as appropriate. Both are widely available and perceived to be “accurate” statistics.

However, since one’s actual life quality is determined by the value of income they actually can earn, and not what they potentially have access to, statistical calculations like the ‘real gross domestic product per person, used in the LQI method, should be deemed vastly inaccurate, deceptive, and unreliable in assessing life quality in a given country since it is merely a calculation of the ‘real gross domestic product’ divided by the total population of a country and not the actual distribution of this value amongst the population, hence why ‘real gross domestic product per person in the LQI calculation is referred to and termed as “access to income” and not actual income. Therefore, for this reason, other similarly derived statistical economic measures for assessing human wellbeing such as income per capita (which is used to assess standard living by dividing gross national income by total population) should be invalidated as it only serves to distort the perception of human wellbeing within a country. To put in another way ; these methods can only be used to lie about the state of affairs within a country and are not useful for anything else.

Hence, considering how unreliable and untrue statistical income measures are in gauging income and well-being for the average person in a given society, we at Fundface opted for a more truthful and reliable way of assessing human wellbeing. We developed a novel framework that excludes statistical lies in favor of political truth. We cross-reference the figures presented in the minimum wage policy of a given country with the United States poverty guidelines to determine life quality for the average working person in that country.

Our reasoning here is; the income amount stated in the minimum wage policy is the base legal amount mandated by the government by which an employer can pay an employee; meaning, the minimum wage encompasses all individual incomes earned within a given society since it is the base legal mandated amount. In other words the minimum wage policy is political truth since it can give us a more accurate and truthful means of gauging income and human wellbeing, than statistical economic measures like GDP or income per capita.

Therefore, since the United States poverty guidelines are considered to be the true world reference for identifying poverty and the income amounts stated in the minimum wage policy is considered to be true income, we can gain a true perspective on life quality for all working members of a given society by cross-referencing the minimum wage of that society with the poverty lines presented in the United States poverty guidelines.

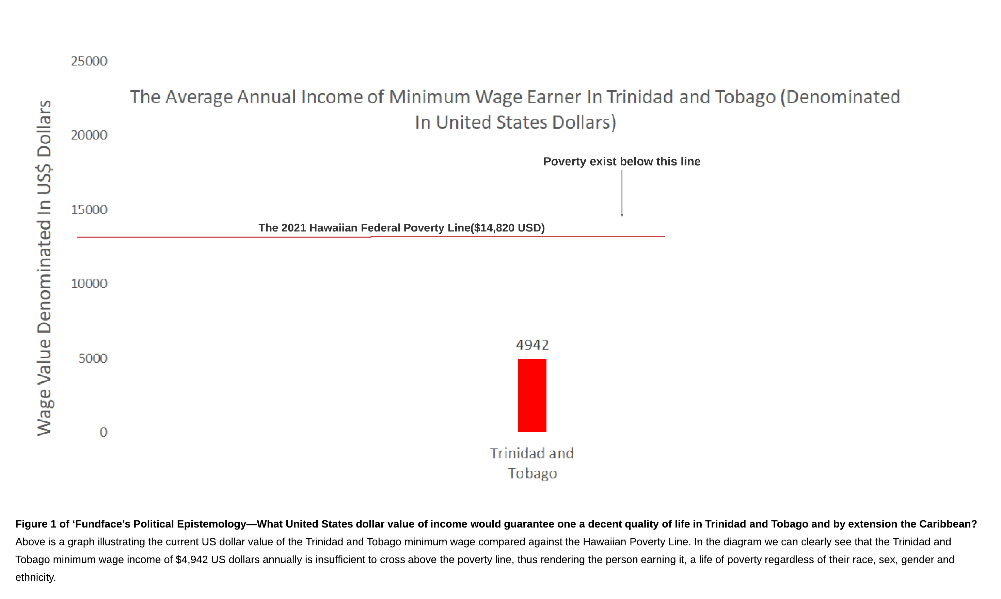

Furthermore, in the United State's poverty guidelines, there are three distinct poverty lines used to assess poverty within the United States, these are, the general poverty line (which encompasses 48 states at US $12,880), the Alaskan poverty line (at US $16,090) and the Hawaiian poverty line (at US $14,820). Because Trinidad and Tobago is identically similar to Hawaii in terms of climate, population size and demographic diversity we opt to use the Hawaiian poverty line to assess poverty in Trinidad and Tobago.

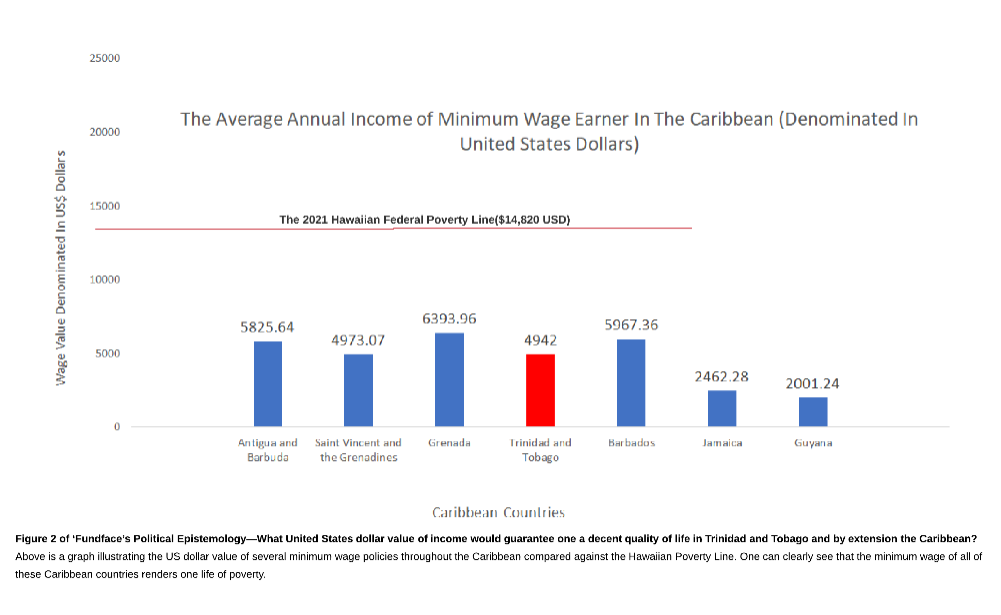

Upon converting the Trinidad and Tobago minimum wage to United States dollars and then comparing it to the Hawaiian poverty line we learn that everyone earning minimum wage and three times the annual minimum wage amount in Trinidad and Tobago lives a life of poverty according to the United States poverty guidelines.

These findings were the same when we examined other Caribbean islands. They all had people living in poverty at three times their annual minimum wage level, some even had poverty at 7 times their annual minimum wage.

Minimum wage is mostly associated with youths since it is the starting salary for most straight out of high school and in between graduating from university.

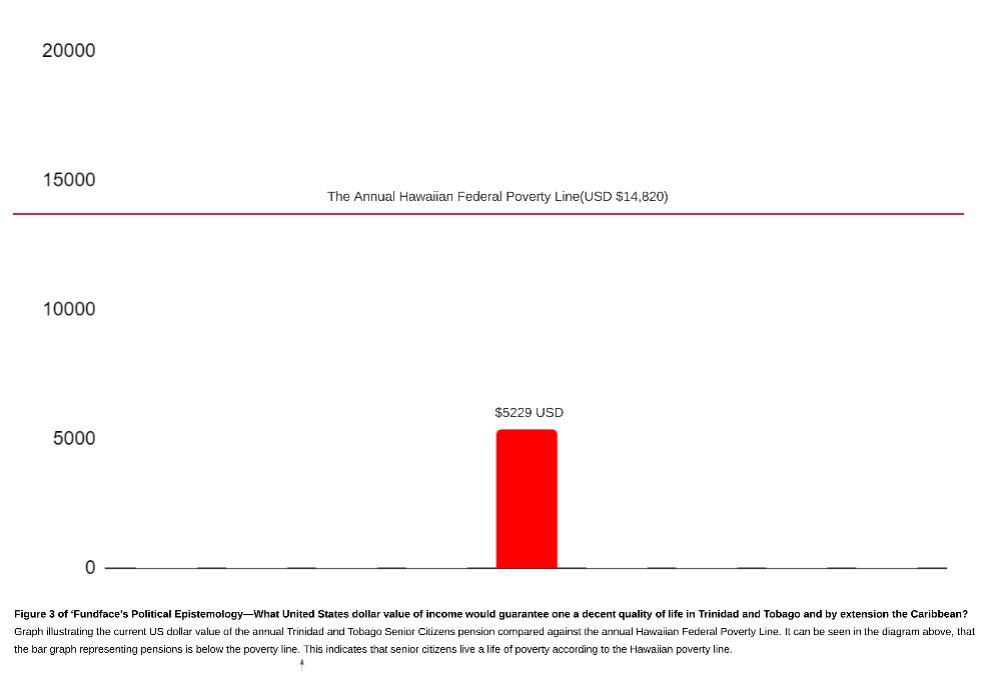

The minimum wage, however, is not the only income experiencing poverty in the twin-island state, pensions are as well.

When we look at pensions issued by the government of Trinidad and Tobago we learn that all elderly persons receiving pensions live a life of poverty according to the Hawaiian individual poverty line.

To conclude, the existence of poverty at multiple times the annual minimum wage amount and at the pension level, suggests that a large unaccounted percentage of the Trinidad and Tobago population is living in poverty and are therefore living an indecent quality of life. Therefore for one to not live a life of poverty in Trinidad and Tobago one simply needs to earn an annual salary above USD $14,820. Easier said than done, however.

What is causing poverty in Trinidad and Tobago?

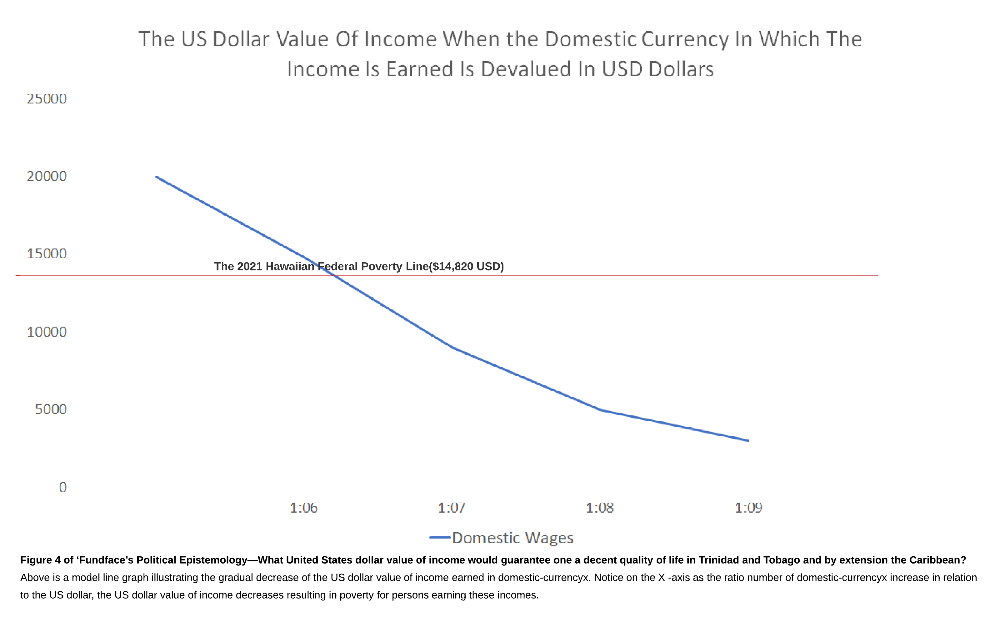

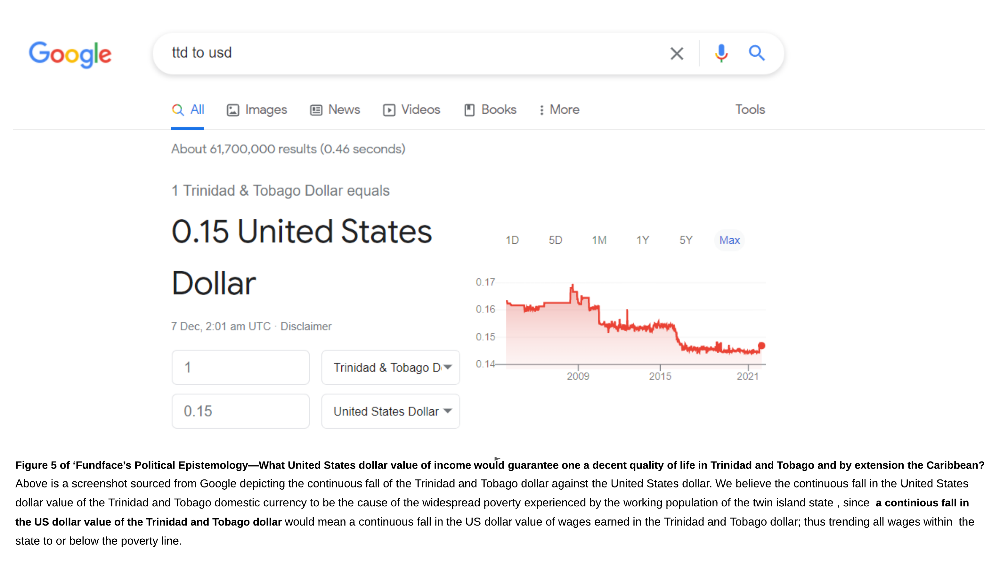

When it comes to identifying the cause of poverty on the individual level in Trinidad and Tobago and elsewhere, domestic currency erosion and domestic currency devaluation can be seen as the main cause of poverty experienced by individuals, since they both mean a reduction in the US dollar value of the domestic currency, which in turn mean a reduction in the US dollar value of wages earned in said domestic currency. Therefore, since we assess poverty using the US dollar-denominated United States poverty-line metric; a gradual or sudden reduction in the US dollar value of these wages, would in turn trend these wages to or below the poverty line or prevent wages from ever crossing above it, thus ensuring or creating poverty for persons earning above or below the poverty line.

While both domestic currency erosion and domestic currency devaluation are fundamentally the same since they both mean a reduction in the US dollar value of a domestic currency and are both the results of macroeconomic forces; they differ significantly in how they come to be.

Domestic currency erosion is the gradual unintentional loss of the US dollar value of a domestic currency. This occurs when the US dollar supply of a sovereign’s economy is gradually depleted over time in relation to the domestic currency supply. This depletion of US dollar supply reserves is recorded by the floating exchange policy as a change in the exchange ratio between the domestic currency and the United States dollar, wherein more domestic currency is needed in exchange for US dollars signaling its devaluation.

The depletion of the US dollar revenue reserves of a domestic economy is typically caused by trade deficits in a country’s balance of payments or simply by a country not earning enough. Economists would call this “the middle-income trap”, however, we at Fundface call it “insufficient financing of a domestic economy”.

Specifically in the case of Trinidad and Tobago; their economy was once diverse in production, meaning they had multiple streams of income, producing products; such as sugar, automobiles and textile, however as world trade grew overtime, these local industries died out due to their inability to compete with ‘economies of scale’ in the international market; in a process which can only be described as “economic natural selection”. The closure of these various industries meant a significant loss of export income for the country, which in turn forced the government to invest and specialize in the production of oil and gas.

Today Trinidad and Tobago is heavily reliant on the production of oil and gas; which as of this present moment, is responsible for over 80% of all the country's export earnings (i.e., majority of the country's US dollar earnings).

However, Trinidad and Tobago's dependence on oil and gas as its main source of US dollar income is a major threat to its economic and financial well-being, mainly because oil and gas are continuously declining in US dollar value over time, which mean less US dollar income for the country as time progress, leading to deficits in its balance of payments, while its local population continue to increase. We believe the declining oil and gas prices to be a result of a combination of several factors ranging from declining demand for gas-powered vehicles in favor of electric-powered vehicles to renewable fuels and climate-conscious policies restricting the sale, purchase and production of fossil fuels.

Nevertheless, Trinidad and Tobago's dependence on the declining commodity is detrimental to its foreign reserve supply, simply because it is not earning enough to replenish after expenditure, which indeed has an adverse negative effect on the price of its domestic currency in the form of domestic currency erosion.

Domestic currency devaluation on the other hand is the intentional reduction in the US dollar value of a domestic currency via the process of seigniorage, wherein a sovereign’s monetary authority increases its domestic currency supply in relation to the domestic foreign currency reserves (their US dollar reserves). This increase in the domestic currency shifts the exchange ratio balance between the two-currency making it cost more domestic currency to exchange for US dollars thereby devaluing the domestic currency against the US dollar.

The purposeful devaluation of a domestic currency is justified by the government and its economists as both a form of tax and a means to boost export earnings for local companies.

Devaluation is a form of tax because taxes are essentially a deduction on income, therefore, since income is deducted by the government through the devaluation of the domestic currency via the profiteering process of seigniorage, one can see why devaluing the domestic currency is considered a tax.

Furthermore, as wages lose US dollar value nationwide as a result of devaluation; the cost of production among companies and national agencies is significantly reduced due to the US dollar reduction on labor cost, leading to higher net US dollar profits for businesses at the expense of its employees. To put in another way; employees are paid less US dollar value for their labor, which in turn boost US dollar earnings for government agencies, but unfortunately at the expense of the employees.

Particularly as it relates to Trinidad and Tobago; it is primarily a struggling socialist state, meaning, the government owns the majority of the means of production, making the government the largest employer within the twin-island. Therefore, it would be in the government’s best interest to cheapen labor through the devaluation of the domestic currency, as a means to both boost profits and collect tax.

Furthermore, the indemnification provided by the Central Bank Act to the Central Bank administration prevents any litigation for the poor management of the local currency system by the Central Bank, thereby preventing any accountability and thus providing no incentive to act in the best interest of the population.

Even so, regardless of how the devaluation of the domestic currency occurs, the devaluation itself remains the sole medium for the impoverishment of a large percentage of Trinidad and Tobago's domestic workforce. And it needs to be stopped!

What are the effects of devaluation?

As we have come to learn; the devaluation of Trinidad and Tobago's sovereign currency is a result of a combination of both the government's intention to do so and the poor macroeconomic health of the country. There is, however, a host of negative societal complications to come from the ever-decreasing US dollar value of the said currency, these negative drawbacks are as follow:

Widespread poverty within the workforce

Previously we explained that poverty is caused by a reduction in the US dollar value of a sovereign currency which in turn is responsible for a reduction in the US dollar value of wages earned in that sovereign currency, thereby trending these wages to or below the poverty line, thus resulting in poverty for the people earning these wages. This is the case for persons earning three times the annual Trinidad and Tobago minimum wage; the poverty they experience is directly due to the domestic currency losing US dollar value. Because poverty is experienced at three times the minimum wage amount; it is understood to be widespread within the workforce.

High violent crime and conflict within a given society

Devaluation can lead to high violent crime and conflict within a society—since devaluation is the cause of poverty and poverty is scientifically understood to be a motivator for violent crime and conflict within a given society.

In a study done by Jonathan Goodhand, it was found that poverty and conflict are widely understood to be closely interconnected; with poverty making countries more prone to civil war, armed conflict and weakening governance and economic performance, thus increasing the risk of conflict relapse.

In another study done by: Humphreys & Weinstein, it was found that: at the state level, poverty can lower resilience to conflict by weakening government institutions, stripping capacity for public goods provision, and limiting the projection of power and authority, whether soft or coercive. Poverty also compounds vulnerability to insurgency at the individual and community level by lowering the opportunity cost of mobilizing for violence. High rates of unemployment and inequality, combined with low levels of education and development, are thought to soften the ground for recruitment and provide motives to fight. These individual correlates of poverty often follow systematic patterns that lead to ‘horizontal inequalities.

Horizontal inequalities occur when members of ethnic, religious, or other identity groups have unequal access to public goods, opportunities, and resources. Group-level inequalities can generate social and economic polarization that increases the risk of violent conflict.

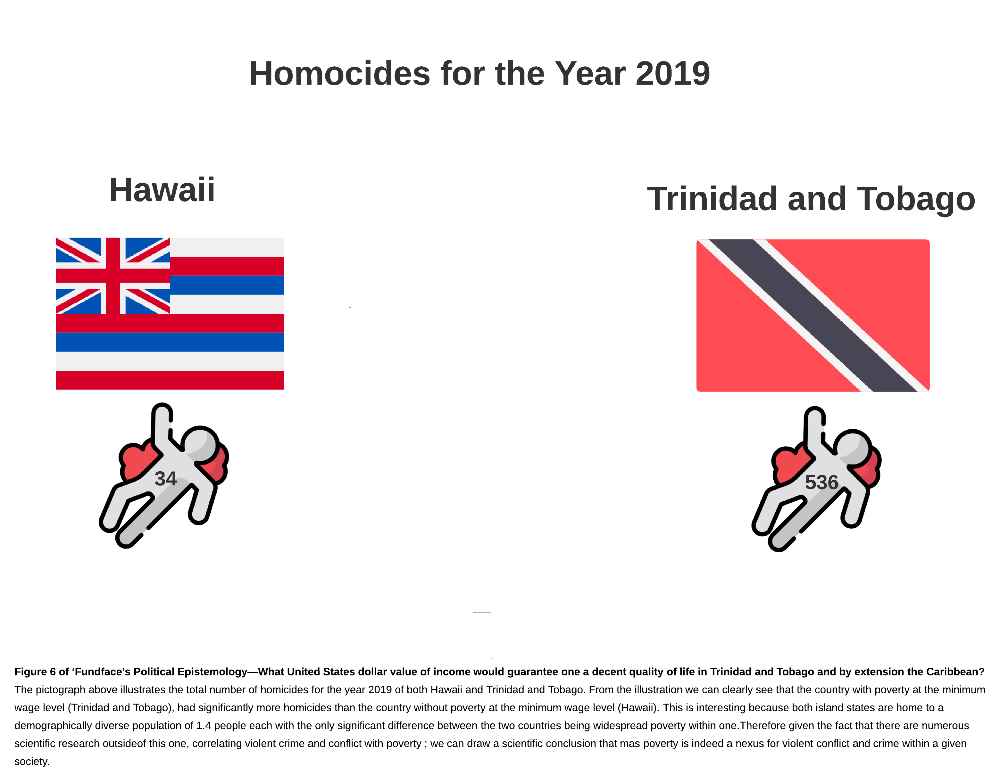

Trinidad and Tobago is no stranger to violent crime and conflict, it ranks among the top 10 countries in the world for murders per million people at the 9th spot. We believe the high homicide rate experienced by the country, to be directly a result of the widespread poverty experienced by the country; we prove this notion via a scientific study of our own; where we scientifically compare the homicide rates of both Trinidad and Tobago and Hawaii during the year 2019. For context reasons (and as mentioned earlier); both Trinidad and Tobago and Hawaii are identically similar to each other; in that, Hawaii and Trinidad and Tobago are tropical multi-island states with an ethnically and racially diverse population of approximately 1.4 million people each. The identical similarities between the two multi-island states make them ideal for scientific comparison among each other, which can help us draw objective scientific conclusions on the subject matter.

From our study, we learn that in Trinidad and Tobago where poverty exist at three times the minimum wage amount according to the Hawaiian poverty and where gun ownership is heavily restricted, due to the domestic policy of the twin-island state —the murder toll in the year 2019 recorded 536 homicides, most of which, were gun-related ( which is ironic for a country with laws that restrict gun ownership); this is in comparison to the 34 murders in Hawaii around the same time frame, wherein the minimum wage exceeds the poverty line and gun ownership is a constitutional right. Therefore, considering all prior academic research correlating violent crime and poverty, one can draw a scientific conclusion from the parallels of this study, that poverty is indeed one of the main reasons for violent crime and conflict within a given society.

Poverty induces mental illness

The poverty induced by the devaluation can cause widespread mental illness in a given society. In a 2010 analytical review of 115 studies that encompassed 33 countries across the developed and developing worlds, nearly 80 percent of the studies showed that poverty is connected with higher rates of mental illness. In these studies, it was found that people living in poverty experience severe mental illnesses that lasted longer and had worse outcomes.

There's also growing evidence that poorer countries inherently have higher levels of depression in them, than wealthier ones. Those kinds of findings challenge a long-held myth of the "poor but happy African sitting under a palm tree," says Johannes Haushofer, an economist and neurobiologist who studies interactions between poverty and mental health at Princeton University.

Poverty prevents social mobility and personal development

From a purely ethnographic perspective, poverty prevents personal development by limiting one's access to quality education and essential resources necessary for personal development.

Devaluation Income Inequality

The devaluation of a given sovereign currency will cause income inequality for professionals in that society. For example, a police officer in Trinidad and Tobago will be paid a lot less as a result of domestic currency devaluation than their American counterpart, working the same hours at the same level of skill and risk.

Devaluation causes brain drain

Due to decreasing domestic wages, highly skilled professionals may be motivated to migrate elsewhere where their labor is valued sufficiently. When highly skilled labor leaves from one country to another we call this phenomenon "Brain Drain".

Slavery

According to google; slavery is defined as a condition of having to work very hard without proper remuneration or appreciation. In Trinidad and Tobago minimum wage jobs are usually labor-intensive, meaning it is hard work, therefore, if these jobs can only afford one life of poverty, then this means that person is being poorly remunerated and it can therefore be said that they are living in slavery.

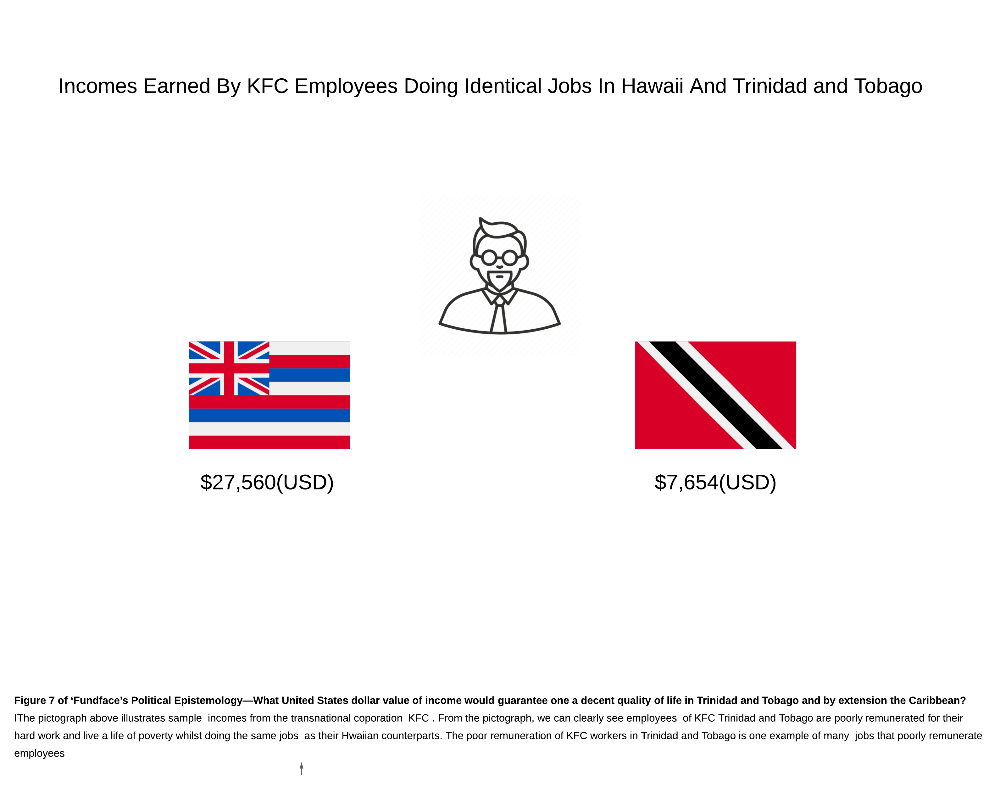

Furthermore, the poor remuneration of domestic workers in Trinidad and Tobago can objectively be observed when we compare the incomes paid to employees of the transnational corporation, KFC.

In our study, we compare the wages earned at KFC Trinidad and Tobago against KFC Hawaii, and from this comparison, we can clearly see that employees in Trinidad and Tobago are poorly remunerated for their hard work performing the same standardized jobs, whilst working the same hours. For example, KFC Trinidad and Tobago pay new employees a starting salary of $25.00 TTD an hour which equates $3.68 USD per hour at an annual total of $7654.40 US dollars per year, whereas KFC Hawaii new employees are paid a starting salary of $13.25 per hour, at an annual total of $27,560 US dollars per year. These differences in the salary paid to workers in Trinidad and Tobago and Hawaii by the transnational corporation KFC is termed by economists as income inequality, Fundface however calls it slavery, because it can be objectively proven to be exactly that.

Restriction of Freedoms

This notion of poverty being the nexus for modern-day slavery is furthered by the fact that it negates one's fundamental human right of freedom by restricting one's ability to move or travel. This restriction in freedoms is due to one's inability to afford it. These restricted freedoms prevent one from accessing better opportunities that could otherwise be accessed elsewhere, for example, a low-skilled minimum wage job in America.

In other words, while one may be perceived to have human rights of 'freedom" by decree in the constitution, one may not get to enjoy these rights because of poverty.

Fundface's Solution

It is very evident that the Central Bank and Government of Trinidad and Tobago have indeed objectively failed to secure the financial wellbeing for many in the working population of its society. As such, to this present day, many live under slavery-like conditions, living a poor life quality filled with misery, mental illnesses, restricted freedoms, and overall despair, at little fault of their own. This current paradigm of unfortunate financial circumstances experienced by many in society presents themselves as a very complex political issue to be solved.

Fortunately, Fundface is a financial advisory company founded by political scientists, who are passionate about solving complex political issues affecting human life quality and overall human well-being. We recognize the shortcomings of the institutions responsible for the well-being of the collective and therefore made it our responsibility to secure the well-being of the many affected by the poor management provided by these institutions.

We undertake this responsibility of securing the financial well-being of many in Trinidad and Tobago and the region by leveraging the international liberal economy (the free market) to enact our political will of producing a just society and a just world.

We believe a just society to be a society where all working members within it are properly remunerated for their hard work, thereby avoiding slavery and the restricted freedoms associated with it.

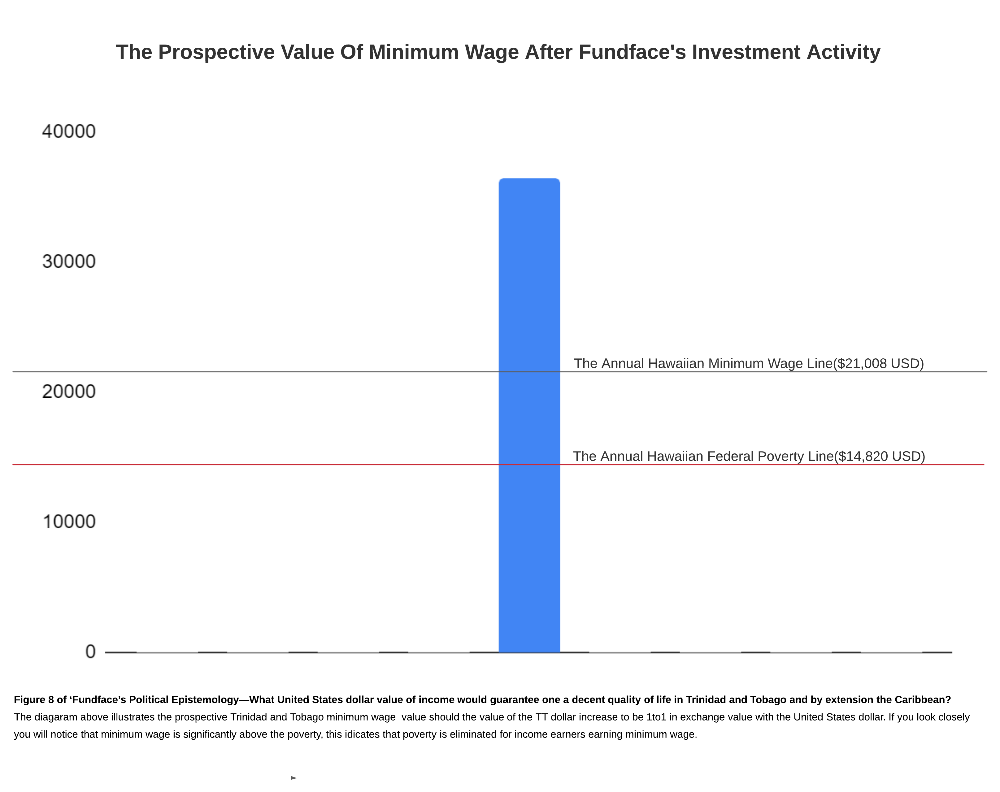

Therefore, to shift this current paradigm of slavery/poverty in Trinidad and Tobago and the Caribbean, we would need to increase the US dollar value of minimum wage to a value amount above the Hawaiian poverty line of USD $14,820. By increasing the US dollar value of minimum wage we can systematically eradicate poverty and by extension slavery for all working members of a given society.

This is because the minimum wage is the base legal mandated amount an employer can pay an employee in a given country, therefore by increasing the US dollar value of the base wage above the poverty line, all working members within that society will live a life free of poverty .

Increasing the US dollar value of a sovereign’s minimum wage policy can be done systematically via the free market by leveraging the floating exchange policy of that sovereign's currency. The floating exchange policy of a sovereign currency facilitates the indiscriminate US dollar price movement of said sovereign currency, thereby, allowing that currency to increase or decrease in US dollar value based on the supply ratio between that currency(the domestic currency ) and the US dollars within a shared domestic economy i.e the free market.

The free-market nature of the pricing mechanism of a sovereign currency presents an opportunity for any willing free market participant with the right resources and technology to systematically revalue the US dollar value of a sovereign currency at will. At Fundface we pride ourselves as the developers of such technology.

We developed special patent-pending technology that functions as an accessory to Fundface Crypto Hedge Fund’s proprietary investment framework. This special technology enables us to profit indefinitely from the controlled revaluation of a sovereign currency thereby allowing us to profit from solving poverty.

Remember revaluing the US dollar value of a sovereign currency is how we systematically remove poverty from a working population. Therefore to have a system and method that profits from the controlled revaluation of a sovereign currency is what makes Fundface a unique and paradigm-shifting company — we are the only company able to profit whilst systematically solving poverty. This has never been done. And we are proud to be the providers of such a solution.

The Benefits We Provide

Fundface’s quantitative hedge fund product is tailored towards institutional clients looking to preserve and appreciate capital over the long term. Therefore, the upfront benefit Fundface aims to provide to investors is exceptional returns over the long term. This is Fundface’s goal above all else. However, one of the steps in our proprietary investment framework involves revaluing the domestic currency of a given country (in this case Trinidad and Tobago) to a predetermined amount. As such there are many beneficial outcomes to revaluing or deflating a sovereign’s domestic currency; specifically for the following groups: the working population, businesses, banks, and government. The benefits to these specific groups are as follows:

Benefits to the average worker

As we have come to learn; people earning roughly three times the annual Trinidad and Tobago minimum wage, live a life of poverty according to Hawaiian poverty guidelines. While this is unfortunate, we know by simply revaluing sovereign currencies, we can revalue income earned in that currency. Therefore, should we increase the value of the TT dollar to be 1 to 1 in exchange value with the United States dollar, it will eliminate poverty and income inequality for all working members of Trinidad and Tobago society. At a 1 to 1 exchange ratio value between the United States dollar and the TT dollar, Trinidad and Tobago minimum wage will be revalued to be $36,400 US dollars in value annually, thus solving poverty for all minimum wage earners, allowing them to live a decent quality of life. So the benefit we provide to the average worker is a life free of poverty and just income.

Benefits to businesses

While the decreasing currency guarantees cheap labor for businesses as a benefit to these businesses, but at the expense of its employees. The benefits of increasing the domestic currency prove to outweigh the benefits of decreasing it. The benefits of increasing the currency for businesses are as follows:

- Businesses earn more due to an increase in consumer income. Consumers with more disposable income are more likely to spend more at local businesses due to an increase in income. So dictates the economic law: the propensity to consume.

- Businesses with savings denominated in the local currency benefit from the US dollar increase allowing them to earn more US dollars, which can in turn be used to expand or improve business leading to more earnings.

Local Banks

As the US dollar price value of the domestic currency rises, so too would the value of the service fees charged by the banks trading in that sovereign currency. Meaning, higher US dollar profit yields for local banks. Furthermore, local assets held by the banks such as land, stocks and local currency all appreciate leading to higher US dollar market caps and higher international credit ratings for these banks.

States and Government institutions

Our proprietary investment framework involves directly investing into small sovereign economies as a means of increasing the value of sovereign currencies. Therefore, the immediate benefit we provide to States is liquidity through the direct investment regime of our proprietary investment framework.

But more than just providing added liquidity, the increase in the US dollar value of the sovereign currency, would mean an increase in the US dollar value of taxable income earned in that currency, meaning more US dollar tax revenue for the government. Furthermore, the increased US dollar value of income would allow previously un-taxable income to become taxable. For example, the minimum wage at Trinidad and Tobago at this present moment is un-taxable at the current annual US dollar value of $4,942, however, should the value of the TT dollar become 1 to 1 in value with the US dollar, the annual US dollar value of minimum wage would become greater than the US dollar value of the current taxable income amount valuing a $10,000.00 US dollars thus qualifying minimum wage to become tax worthy. This would mean an additional tax revenue stream for the government from minimum wage earners; who were previously nontaxable therefore leading to more income and bigger budgets.

Conclusion

In conclusion, we at Fundface believe that, regardless of one's geopolitical alignment, one earning minimum wage should not be the reason why one is poor or lives in poverty. We believe that minimum wage should allow one a decent quality of life regardless of their geographic dwelling. We believe that because the world currency is the United States dollar; the minimum wage of a given society should always be above the figures stated in the United States poverty guidelines.

However, unfortunately, many in Trinidad and Tobago and the wider Caribbean at this present moment are unfairly remunerated for their hard work and thus live a life of poverty and in most cases, slavery at no fault of their own, but rather evidently through intentional acts of their government.

Therefore when the authorities of a country who would otherwise be responsible for the wellbeing of everyone in the collective, choose to purposely debilitate life quality for the many under their governance; then the responsibility of securing the collective’s well-being falls on the private citizens or groups with the scientific knowledge and technology to do so.

This is why Fundface exists and why we aim to revalue sovereign currencies with our proprietary investment framework. Fundface prides itself in knowing its investment framework is the only viable solution to the mass poverty issue affecting the small sovereign states in the Caribbean region. We believe appropriately revaluing a sovereign currency via the free market to be the most time effective and scientific way of eradicating poverty within a given society's labor force, since revaluing the US dollar value of a sovereign's currency would mean the revaluation of wages earned in that currency. This is how we secure the interest of the many in the Caribbean as a private entity. And we do this because we care.